Reduce time to market and save millions in setup costs with our turnkey card-issuing solutions. Enable real-time fund access for your clients through Mastercard and Visa’s global networks.

Banking & Financial Services

Save Millions

on Card-Issuing

Avoid the high costs of building and maintaining a card programme in-house. Our turnkey solution delivers everything you need—without the overhead.

Launch a fully managed card programme with minimal upfront investment

Eliminate infrastructure, compliance and development expenses

Reallocate resources to focus on client services and growth

Accelerate

Your Time to Market

Skip the lengthy development cycle. Our end-to-end solution helps financial institutions launch card programmes faster—without the usual delays.

Reduce time-to-market with a ready-to-deploy issuing platform

Avoid complex setup and integration hurdles

Leverage our global issuing network and regulatory expertise

Unlock Global Access

for Your Cardholders

Empower your clients to spend confidently across borders with cards backed by major global networks and multi-currency support.

Support for EUR, GBP, USD, CAD, AUD, CHF and more

Leverage trusted global networks like Mastercard and Visa

Ensure worldwide accessibility—whether online, in-store or at an ATM

Elevate Your Brand

with White-Label Cards

Enhance client loyalty and brand visibility by offering fully customized payment cards that reflect your institution’s identity.

Launch branded card products without building infrastructure

Customize the card design and user experience to match your brand

Deliver a personalized product your clients will recognize and trust

Preferred Payout Methods

for Banking & Financial Services

The Intercash approach is to provide a turnkey solution with all components in the issuing chain included, leaving clients free to focus on the growth of their business.

Plastic Cards

Learn More

When it comes to financial services, physical cards provide a dependable and widely accepted payment method, ensuring your clients have access to their funds wherever they go.

Virtual Cards

Learn More

Ideal for online payments, virtual cards offer a flexible and secure alternative to traditional payment methods, enabling clients to complete transactions without the need for a physical card.

Debit Cards

Learn More

Unlike prepaid cards, debit cards are directly linked to your clients’ bank accounts, offering a straightforward and transparent method for their everyday purchases and transactions.

Explore how our card programmes deliver value and improve payment operations for financial institutions.

Key Benefits

for Banking & Financial Services

Brand Loyalty

Offer fully customisable white-label card products that showcase your brand identity, creating stronger connections and lasting client loyalty.

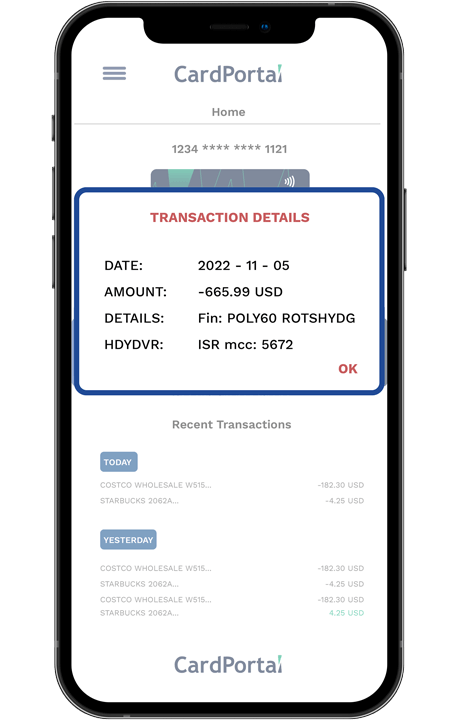

Real-Time Access

Provide your clients with immediate access to their money, enhancing convenience and overall satisfaction with every transaction.

Seamless Integration

Leverage our suite of APIs to Integrate card programmes into your existing banking platform with ease, reducing disruptions and operational complexities.

Global Coverage

Enable your clients to make purchases and ATM withdrawals wherever Mastercard and Visa are accepted, empowering them with reliable payment options on a global scale.

Multi-Currency Support

Support card payments in EUR, USD, GBP and several other prominent currencies, simplifying travel and international transactions for your clients.

Enhanced Security & Compliance

Rely on our advanced security and regulatory expertise to protect your clients’ transactions while ensuring full compliance with AML, GDPR and other industry standards.

Seamless Integration

for Financial Institutions

Integrating new payment solutions can often feel like a complex and disruptive process for financial institutions. Intercash offers a full suite of APIs for integration, simplifying the transition and minimizing disruptions.

By leveraging our APIs, you can integrate a custom card programme into your banking platform with ease. Our payment solutions are compatible with most leading banking software, including:

Case Study

The Merchant

Renowned for its global reach, this financial institution provided innovative multi-currency and asset management solutions. With a focus on serving diverse client needs, they built a reputation for delivering secure and efficient banking services worldwide.

A convenient payment product to offer clients

Need

Banking & Financial Services

Industry

UK

Head Office

The Challenge

This merchant was looking to provide their clients with a convenient payment product that would allow them access to their funds from anywhere in the world. However, as a non-scheme member financial institution, they did not have the ability to issue their own bank cards. They required support to implement a turnkey payment card solution into their banking platform, while maintaining their branded experience for clients on the front line.

The Solution

Intercash worked with this financial institution to launch a practical and effective payment card product for their clients. This was accomplished with the help of PrepaidGate, Intercash’s proprietary and turnkey card programme management engine. This platform controls all the integrated partners in the issuing chain, including numerous issuing banks, processors, card manufacturers, acquirers and connections to multiple schemes.

Results

Convenient Mastercard product available for clients to access their funds

Spend and withdraw cash via Mastercard network at millions of locations globally

Simple implementation by integrating the APIs into the core banking platform

Quick, efficient and cost-effective plan for adding card product to the banking system